Location-Based Taxes Management allows you to apply different tax rates based on store/warehouse location, giving you full control over regional tax regulations, local tax rules, and multi-location fulfillment scenarios.

Before configuring this feature, you must:

Step 1 — Add Tax Rates in WooCommerce

To add tax rates globally:

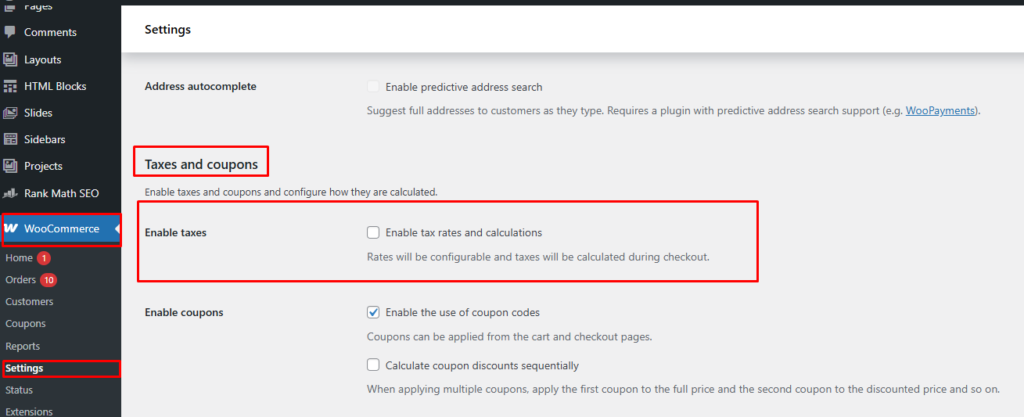

- Go to WooCommerce → Settings → Tax

- Enable taxes (if not already enabled)

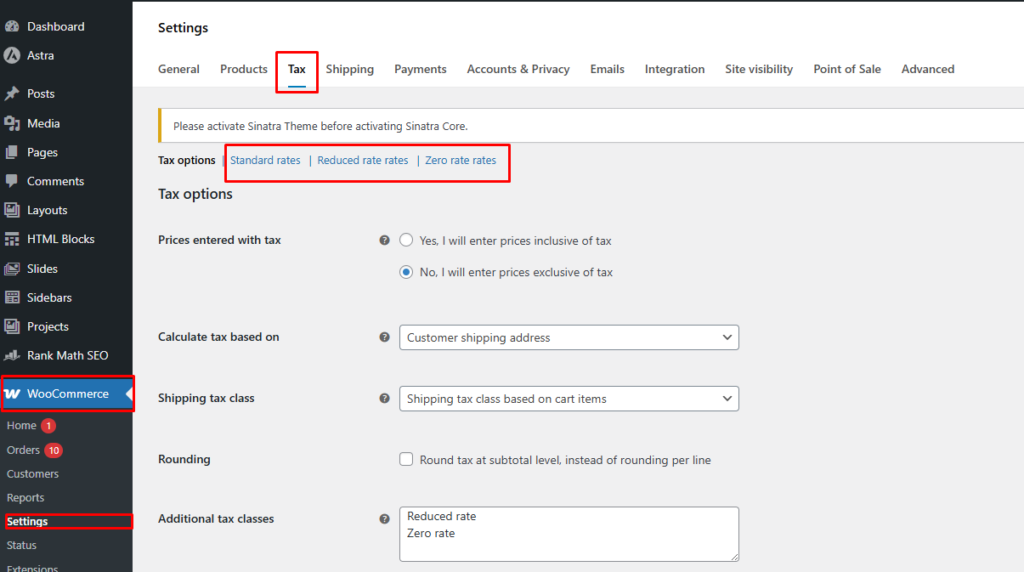

- Open:

- Standard Rates

- Reduced Rates

- Zero Rates

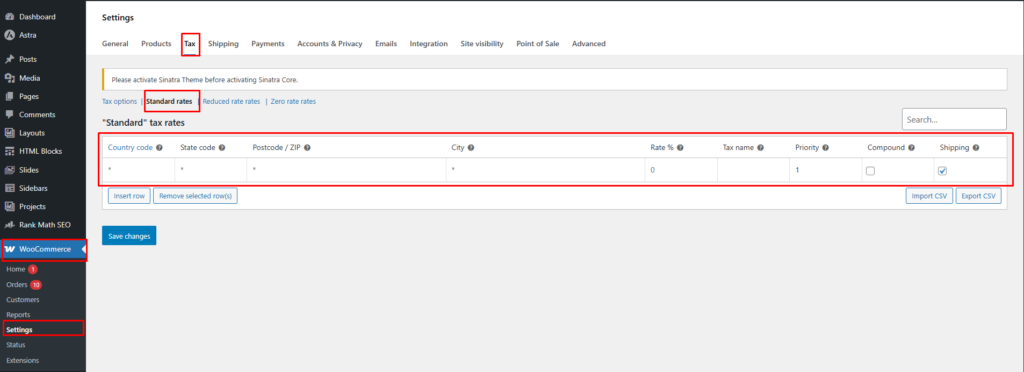

- Add tax rules such as:

- Country code

- State code

- Postcode

- Rate (%)

- Tax name (e.g., VAT, GST, Sales Tax)

- Priority and compound settings

These tax rates become available to assign to different store locations.

Step 2 — Assign Taxes to Each Location

Once tax rates exist, assign them to specific store locations:

- Go to Location Manage → Locations

- Edit or Add New Location

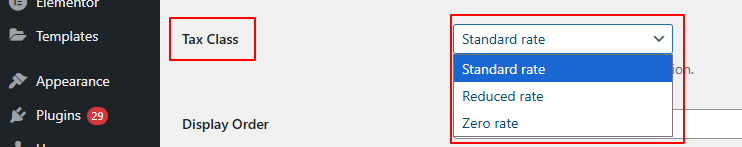

- Scroll to Tax Class / Tax Settings

- Select the tax class applicable for that location (e.g., Standard, Reduced)

- Save changes

Each location now has its own tax behavior and rate rules.

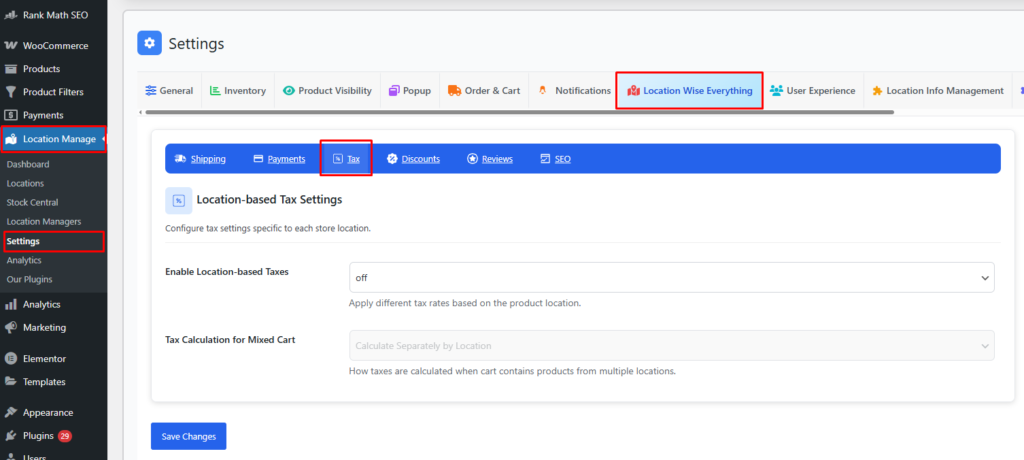

Step 3 — Configure Location-Based Taxes

Now enable location-wise tax logic.

- Go to Location Manage → Settings

- Open Location Wise Everything → Tax

Enable Location-based Taxes — ON/OFF

- ON

Taxes are applied based on product location and assigned tax classes. - OFF

WooCommerce uses global/default tax settings for all locations.

Tax Calculation for Mixed-Location Carts

When the cart contains products from multiple locations, you can choose how taxes should be calculated.

Inside the Tax settings, choose:

Tax Calculation for Mixed Cart Options

1. Calculate Separately by Location

Recommended for multi-warehouse stores

- Each location’s products are taxed using its own tax rate

- Total tax is the sum of each location’s tax calculation

- Useful for fulfilling orders from multiple regions with different tax rules

2. Based on Shipping Location

Tax calculated based on customer’s shipping address

- All products use tax rules based on the shipping destination

- Common for regional sales tax systems (USA, Canada)

3. Based on Billing Location

Tax tied to the customer’s billing address

- Often required for digital goods (VAT regulations in EU)

- Useful when billing address is the legal basis for taxation

4. Based on Store Location

Tax applied based on the primary store location

- All items use the tax rate of the selected store/warehouse

- Works well when:

- Taxes are uniform at the store level

- You want centralization and simplicity

Example Scenarios

Example 1: Multi-Warehouse Order

Cart contains:

- Product A (Location 1 — 10% tax)

- Product B (Location 2 — 7% tax)

If Calculate Separately by Location is selected:

Tax on A = 10%

Tax on B = 7%

Total tax = combined tax values

Example 2: Regional Delivery

User ships to California (8.25% tax)

If Based on Shipping Location is selected:

All products apply 8.25% tax

Example 3: Digital Goods (Billing-Based)

Customer billing address = Germany (19% VAT)

If Based on Billing Location is selected:

All digital products apply 19% VAT

Example 4: Store-Controlled Tax

Store Location = New York (8.875% tax)

If Based on Store Location is selected:

Entire cart uses 8.875% tax rate

Benefits of Location-Based Tax Control

✔ Compliance with regional laws

Different warehouses support different regions and tax rules.

✔ Accurate multi-location fulfillment

Each warehouse can have its own assigned tax class.

✔ Flexible calculation options

Mixed-cart logic ensures transparency and accuracy.

✔ Seamless checkout experience

Customers see the correct tax based on your chosen rules.

Best Practices

- Always assign correct tax class per location

- Use “Calculate Separately by Location” for multi-hub shipping

- Use shipping-based tax calculation for physical deliveries

- Use billing-based calculation for digital or legal compliance regions

- Test checkout with different location selections to confirm tax behavior

Location-Based Tax Management gives you complete control over how taxes are calculated and displayed across multiple warehouses—ensuring accuracy, compliance, and a smooth customer checkout experience.