Handling large online transactions can be challenging, especially when you’re dealing with high-value transfers between banks. Many businesses today prefer ACH (Automated Clearing House) payments for their low fees and direct account-to-account processing. But when the amount is significant, like a $75,000 transaction, one question often comes up — can WooCommerce do a $75,000 ACH payment?

The short answer is yes, WooCommerce can handle a $75,000 ACH payment, but not on its own. The platform relies on third-party payment gateways such as Stripe, ACH, Dwolla, or Authorize.net eCheck to process such large transfers. The actual limit depends on your chosen gateway, bank verification level, and account history, not WooCommerce itself.

If you’re planning to process large ACH transactions through your WooCommerce store, it’s essential to understand the rules, limits, and compliance requirements involved. Keep reading to learn how WooCommerce supports ACH payments, which gateways allow high-value transfers, and what steps to take for smooth and secure processing.

Can WooCommerce Do a $75,000 ACH Payment?

Yes, WooCommerce can process a $75,000 ACH payment — but only through the right setup. The platform itself doesn’t handle payments directly; instead, it connects to external gateways that process the funds securely between banks. When properly configured, WooCommerce can manage large transactions just as efficiently as smaller ones. Here’s how it processes large amounts of money step by step:

Customer Initiates Checkout

The process starts when a customer selects ACH as the payment method during checkout. WooCommerce passes the payment details — such as account number, routing number, and total amount — to a supported gateway (like Stripe ACH, Dwolla, or Authorize.net eCheck).

Payment Gateway Verifies Bank Accounts

Before the payment can proceed, both the merchant and customer accounts are verified. This may include micro-deposit validation or instant account linking through services like Plaid or Dwolla. Verification ensures the funds come from legitimate sources and meet banking security standards.

Transaction Request Is Submitted to the Bank

Once verified, the gateway sends a payment request through the ACH network (Automated Clearing House). The ACH system batches and processes the request, moving the funds electronically from the customer’s bank account to the merchant’s account.

Gateway Reviews for Risk and Limits

For large amounts like a $75,000 payment, the gateway runs an internal risk assessment. It checks account limits, transaction history, and fraud risk before approving the transfer. Some gateways may temporarily hold the funds for review, especially for first-time or unusually large transactions.

Compliance and Encryption Protect the Transaction

Ensuring your store setup is WooCommerce PCI Compliant is vital for handling large ACH transactions safely. Every payment must follow PCI DSS and NACHA regulations to protect sensitive financial data during transfer. WooCommerce relies on compliant gateways that encrypt and tokenize customer information, reducing risks and keeping your business aligned with industry security standards.

Settlement and Fund Transfer

ACH transfers typically take 3–5 business days to settle. The bank credits the merchant’s account once the payment clears, and the WooCommerce order status automatically updates to “completed.” This process might take slightly longer for larger sums as the banks perform extra verification.

Transaction Logs and Reporting

WooCommerce records all payment details in your dashboard for auditing and transparency. Through gateway plugins, you can access full reports, including transaction IDs, timestamps, and clearing confirmations — helping you stay compliant with financial regulations.

Notifications and Order Confirmation

Finally, both merchant and customer receive email confirmations once the payment is successful. If any delay or verification issue occurs, WooCommerce and the gateway automatically send status updates. This keeps both parties informed until the payment fully clears.

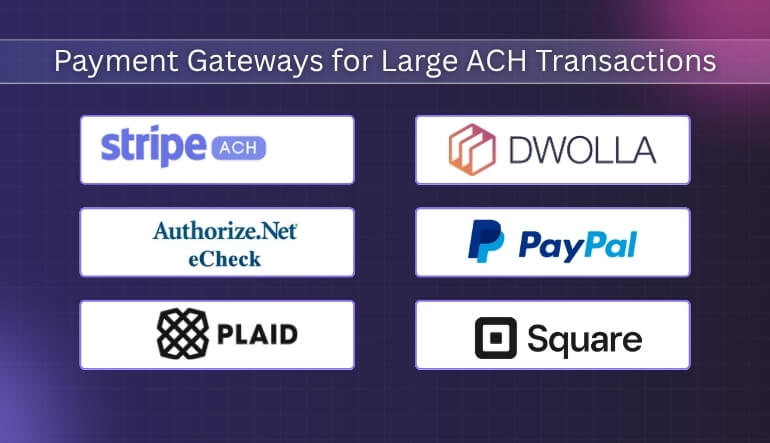

Best Payment Gateways for Large ACH Transactions

WooCommerce doesn’t process ACH transactions directly—it relies on integrated gateways that handle funds securely between banks. The right solution ensures smooth transfers for high-value WooCommerce transactions. Here are some of the best ACH payment gateways compatible with WooCommerce for large transactions.

Stripe ACH

Stripe ACH is one of the most popular and reliable gateways for processing large bank-to-bank payments. It supports ACH Direct Debit, offering businesses the ability to accept high-value transfers directly from customer accounts. With verified merchant accounts, Stripe can process transactions exceeding $75,000. It includes built-in PCI compliance, tokenization, and strong encryption to protect sensitive data. Stripe also provides real-time verification through Plaid, reducing the risk of payment failure.

Dwolla

Dwolla specializes in ACH processing and is built specifically for handling large electronic payments. It offers customizable transaction limits depending on business verification level and compliance standing. Dwolla’s ACH transfers are fast, transparent, and fully NACHA-compliant, making it ideal for businesses handling recurring or high-value payments in WooCommerce. The platform also provides advanced fraud detection tools and supports seamless integration through its WooCommerce plugin or API.

Authorize.net eCheck

Authorize.net eCheck is a long-trusted option for merchants processing ACH payments. It enables WooCommerce store owners to accept direct bank transfers with low transaction fees and supports substantial payment volumes. For larger payments, Authorize.net often requires additional verification, but once approved, it can process up to $100,000 per transaction, depending on account type. It also offers PCI DSS-compliant encryption and fraud prevention filters for added security.

PayPal ACH (via PayPal Business)

While PayPal is primarily known for card and wallet payments, its PayPal Business account supports ACH payments for verified U.S. merchants. Large transfers can be completed through the PayPal ACH Direct feature, with limits based on account history and verification. PayPal’s integration with WooCommerce is seamless and comes with extensive protection policies, making it a strong choice for businesses that already use PayPal for other transactions.

Plaid

Plaid acts as a bridge between WooCommerce and financial institutions, simplifying bank account verification for ACH transactions. While Plaid itself doesn’t process payments, it connects to processors like Stripe and Dwolla to authorize high-value transactions safely. Its instant verification technology helps speed up ACH payments while maintaining compliance with PCI and NACHA standards.

Square ACH Payments

Square recently expanded its ACH capabilities, allowing businesses to process bank transfers alongside traditional payments. Through the Square for WooCommerce integration, verified merchants can handle large ACH transactions securely. Square ensures all data is encrypted and compliant, making it a suitable choice for businesses that already use Square POS or invoicing systems.

How to Configure WooCommerce for High-Value ACH Payments?

To process large payments such as a $75,000 ACH transaction, WooCommerce needs to be properly configured with a secure, verified payment gateway and a compliant system setup. Below is a step-by-step guide to configure WooCommerce for handling high-value ACH payments safely and efficiently.

1. Start with a Secured Checkout Plugin

Begin by using a secure checkout tool like the WooCommerce One Page Checkout plugin. It simplifies the checkout process, reduces entry points for sensitive data, and strengthens security by processing everything on a single page. This setup not only improves user experience but also lowers the risk of data interception during high-value ACH payments.

2. Choose a Reliable ACH-Compatible Gateway

Select a trusted ACH payment gateway that supports large transaction limits. Options such as Stripe ACH, Dwolla, or Authorize.net eCheck integrate seamlessly with WooCommerce and meet compliance standards. Confirm with your gateway provider that your account can handle transactions up to or above $75,000.

3. Verify Your Merchant Account and Banking Details

Before accepting high-value payments, complete all verification steps required by your gateway. This includes submitting business credentials, bank account details, and tax information. Most providers use micro-deposit verification or instant validation through Plaid to ensure account authenticity and prevent fraud.

4. Install and Configure the Gateway Plugin

After approval, install the official WooCommerce extension for your chosen ACH gateway. Go to: WooCommerce → Settings → Payments → Add Payment Method. Activate the plugin, enter your API credentials, and configure the gateway’s ACH settings. Enable tokenization to protect financial data by replacing sensitive details with secure, encrypted tokens during payment processing.

5. Ensure PCI Compliance and Data Security

Handling large payments demands strong compliance. Use SSL certificates, secure hosting, and regularly update all plugins. While the gateway manages encryption and tokenization, maintaining PCI DSS and NACHA compliance at the store level is crucial for full security coverage.

6. Enable Two-step Bank Verification

Activate two-step bank verification to confirm both merchant and customer accounts before processing large payments. Gateways such as Stripe ACH and Dwolla often use Plaid or micro-deposit verification to validate accounts securely, reducing the risk of payment reversals.

7. Test Your Setup in Sandbox Mode

Use the gateway’s sandbox environment to run test transactions before going live. This helps verify the connection between WooCommerce, your gateway, and the bank, ensuring all steps — from checkout to confirmation — function correctly for large ACH payments.

8. Set Transaction Alerts and Notifications

Enable transaction alerts to receive notifications whenever large ACH payments are initiated or completed. Some gateways allow setting thresholds for alerts, which helps detect irregular transactions quickly and maintain transparency for both the merchant and the customer.

Security and Compliance Considerations

Processing large ACH payments, such as $75,000 transfers, requires more than just a capable gateway—it demands strong data protection and strict adherence to financial regulations. To keep transactions secure and compliant, WooCommerce store owners must follow these security standards and best practices across every payment stage.

- Follow PCI DSS Standards: Use PCI-certified gateways, SSL encryption, and secure hosting to protect customer financial data.

- Meet NACHA Regulations: Ensure your payment gateway complies with ACH rules for authorization, fraud detection, and large-amount processing.

- Use Data Encryption and Tokenization: Encrypt all payment data and rely on tokenization to prevent exposure of real bank details.

- Choose PCI-Compliant Hosting: Select hosting that includes firewalls, malware protection, and regular system updates.

- Enable Strong Authentication: Use two-factor authentication (2FA) and limit access to trusted admin users only.

- Run Regular Security Scans: Perform quarterly PCI scans and routine malware checks to detect potential threats early.

- Manage Plugins Responsibly: Keep all plugins updated, remove unused ones, and verify developer credibility to maintain compliance.

- Get Customer Authorization: Require verified digital consent or signatures for large ACH payments to prevent disputes.

Frequently Asked Questions

Processing large payments through WooCommerce can raise a few important questions about limits, fees, and reliability. To make things clearer, here are some frequently asked questions with straightforward answers to help store owners understand how large ACH payments work in WooCommerce.

Can WooCommerce Handle a $75,000 ACH Payment?

Yes, WooCommerce can handle a $75,000 ACH payment through verified third-party gateways like Stripe ACH, Dwolla, or Authorize.net. The limit depends on your gateway’s policies and account verification level, not WooCommerce itself.

How Long Does It Take for a Large ACH Payment to Clear?

Large ACH transfers typically take between three to five business days to clear. Some banks may hold high-value transactions longer for review or additional verification.

Are There Fees for Processing Large ACH Payments?

ACH payments usually cost less than credit card transactions—most gateways charge between 0.5% to 1% per transaction, making them a cost-effective choice for large payments.

Do I Need a Special Plugin for ACH Payments in WooCommerce?

Yes, WooCommerce requires an ACH-compatible plugin or payment gateway integration such as Stripe ACH or Dwolla. These handle verification, encryption, and compliance automatically.

What Happens If a Large ACH Payment Fails?

If an ACH payment fails, the gateway notifies both the merchant and customer. Common causes include insufficient funds or unverified bank accounts. The transaction can be retried once the issue is resolved.

Are ACH Payments Safe for Large Transactions?

Yes, ACH payments are very secure when processed through PCI- and NACHA-compliant gateways. Data encryption, tokenization, and account verification protect both parties throughout the process.

Can WooCommerce Process Recurring ACH Payments?

Yes, many gateways support recurring ACH billing, allowing you to automate payments for subscriptions or ongoing services. Ensure your gateway supports tokenized payment storage for this feature.

What Should I Do to Prepare for High-Value Transactions?

Verify your merchant account, ensure your gateway allows large ACH payments, use SSL encryption, and maintain PCI compliance. Testing the system with smaller transfers before large ones is also a good precaution.

Conclusive Words

Managing high-value online payments requires more than just a reliable store setup—it demands strong security, verified gateways, and complete compliance. So, can WooCommerce do a $75,000 ACH payment? Yes, it can, provided your system is configured correctly with a trusted ACH-compatible gateway like Stripe, Dwolla, or Authorize.net.

The ability to process such large payments depends on your gateway’s verification level, banking policies, and compliance with PCI DSS and NACHA standards. When all these elements are in place, WooCommerce becomes a secure and flexible platform capable of handling both everyday transactions and major business transfers with confidence.

If your store regularly processes high-value payments, taking the time to set up your WooCommerce ACH system properly will pay off in reliability, customer trust, and long-term business growth.